Before commencing my PhD, I worked as an econometrician in PwC’s Economic Consulting team in London for ~5 years between 2016-2020 and 2021-2022. Below are some of my key projects and highlights during this period.

Portfolio

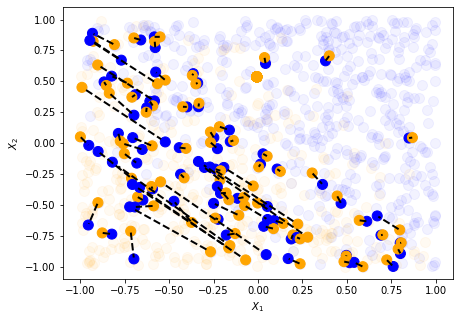

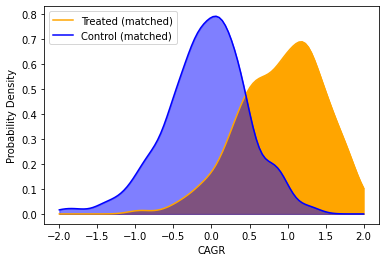

Estimating the effect of SME lending on growth

In 2019 I was the lead econometrician on a project for one of the largest 15 global retail banks. The project was aimed at quantifying the effect of green lending products for Small to Medium Enterprises (SMEs) on subsequent revenue growth. Since the client could only provide data on firms that took part in their scheme, a key challenge was identifying and selecting an appropriate control group. To do this, we combined the client’s data with our own database of SMEs, and used non-parametric propensity score caliper matching to select the control group based on a high-dimensional set of potential confounders. We found statistically significant and positive effects of SME lending on firm growth, and our project results featured in the client’s Annual Sustainability Review.

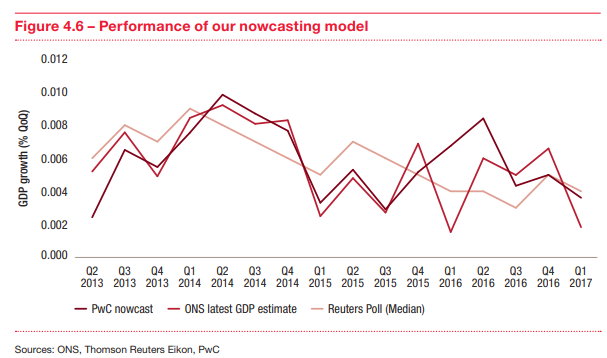

Nowcasting UK GDP growth

Between 2017-2020 and 2021-2022 I developed and maintained PwC’s Nowcasting Model for GDP growth, which we initially launched and published in July 2017. The main idea behind this project was to leverage higher frequency (i.e. daily-monthly) economic indicators to provide an early prediction of lower frequency (i.e. quarterly) GDP growth releases by the ONS. The first model we developed used standard high-dimensional linear regression methods with elastic net penalties. In later iterations, I developed and implemented high-dimensional Bayesian regression models with novel shrinkage priors and a bespoke Markov Chain Monte Carlo (MCMC) algorithm. This enabled us to more reliably adapt to the inherent sparsity in the data, incorporate in prior knowledge about key economic relationships, and quantify uncertainty around point estimates. Our forecasts were on average within 0.1% of the predicted quarterly GDP growth in out of sample testing.

Quantifying the effect of CEO contract incentives on share buybacks and investment

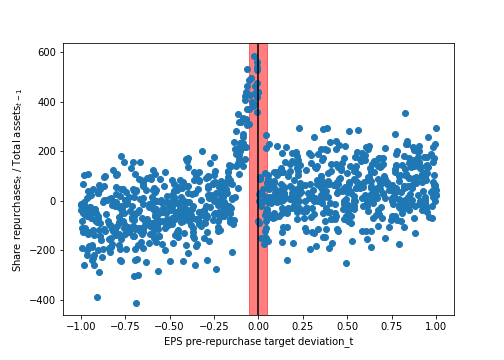

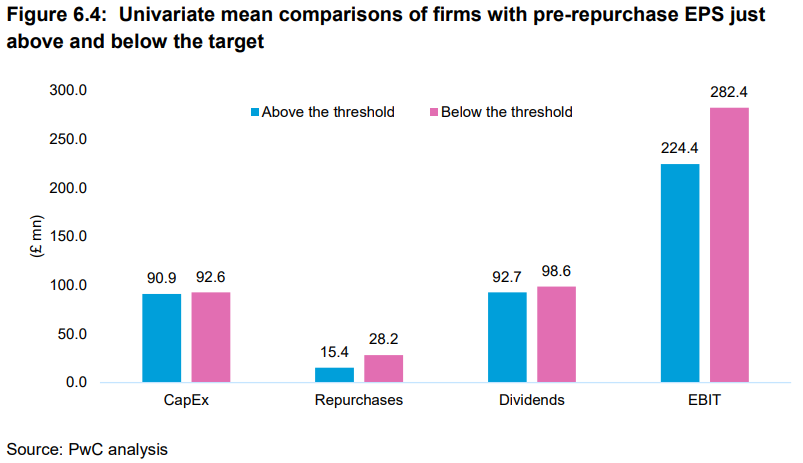

I was PwCs lead econometrician for two projects commissioned to PwC in 2018 and 2020 (in collaboration with Professor Alex Edmans at London Business School) by the UK Government’s Department for Business, Energy and Industrial Strategy (BEIS) on executive pay, share buybacks and investment in the UK. The first project aimed to identify whether Earnings Per Share (EPS) targets in CEO contracts encouraged firms to undertake share buybacks to artificially hit EPS targets and/or reduce investment, using a proprietary dataset of FTSE350 companies. To remove the effect of potential confounders, we used various identification strategies - most notably a Fuzzy Regression Discontinuity Design where we tested whether firms with EPS just below target before repuchasing was a significant predictor of subsequent share buybacks (and reduced investment). The subsequent study focussed more closely on the direct link between CEO contract targets and investment levels, and used similar identification and estimation techniques.

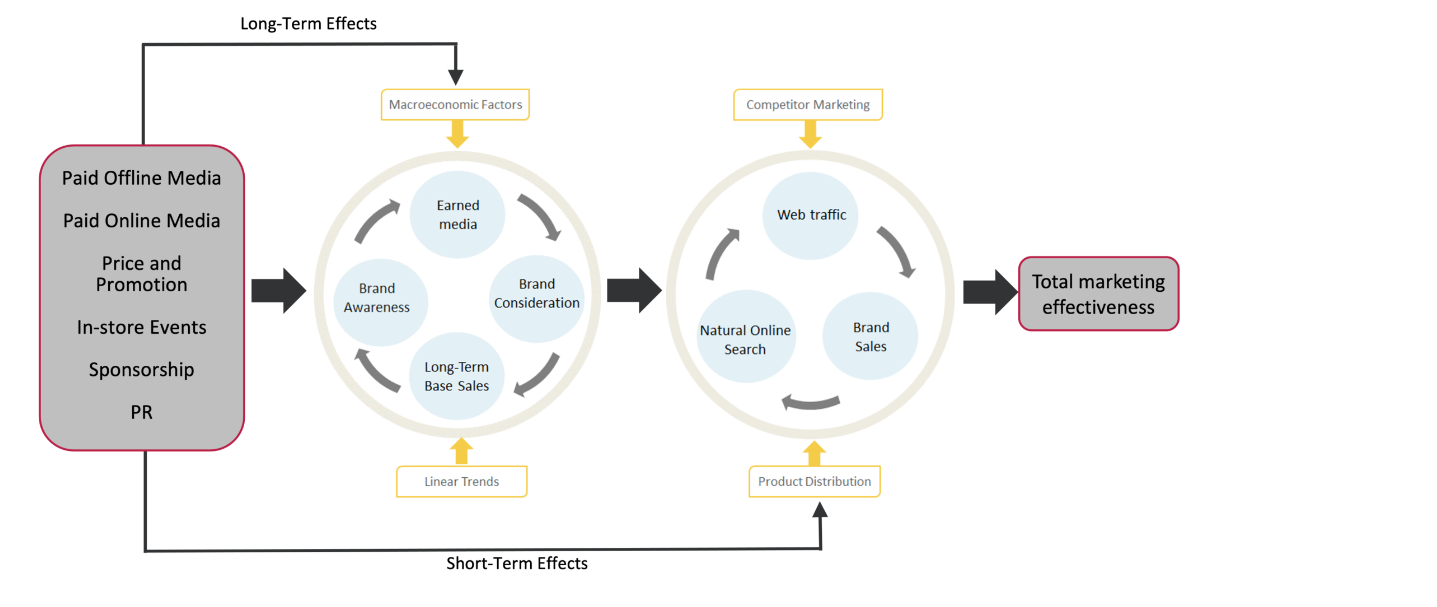

Marketing effectiveness for a global airline

Between 2018-2020 we collaborated with marketscience to optimise the marketing allocation of a leading international airline. We used likelihood-based causal discovery methods to infer causal relationships between marketing channels, identify confounders and mediators, and therefore enable sales attribution. We also used non-stationary time-varying parameter models in order to more reliably identify both long-term and short-term marketing effects on sales, by comparison to typical adstock multiplier approaches. Image source from marketscience.